Bank officials proclaim themselves “stoked” by disappearance of depositor protection.

In a remarkable display of modern financial marketing presentation techniques the cancellation of Kiwbank’s deposit guarantee is being portrayed as an advantage for........Kiwibank’s depositors.

The 14 year old deposit insurance scheme will disappear on February 28 next year.

The deposit guarantee was always an important selling proposition for Kiwibank. The reason is that other New Zealand bank deposits are not guaranteed by anyone and certainly not the government.

Kiwibank marketeers are slickly presenting the pending disappearance of the bank deposit guarantee as an example of the bank maturing and generally coming of age.“This reflects how far Kiwibank has come.......We are now a successful and profitable bank...so a guarantee to give customers confidence in a brand new bank is no longer needed.”

The grounds for seeking to convert what is in customer terms is a negative into giving the appearance of a full-fledged advantage attribute is based on the investment in the bank by the New Zealand Super Fund and Accident Compensation Corporation.

“It means the profits Kiwibank delivers will continue to stay in New Zealand directly benefitting all Kiwis.”

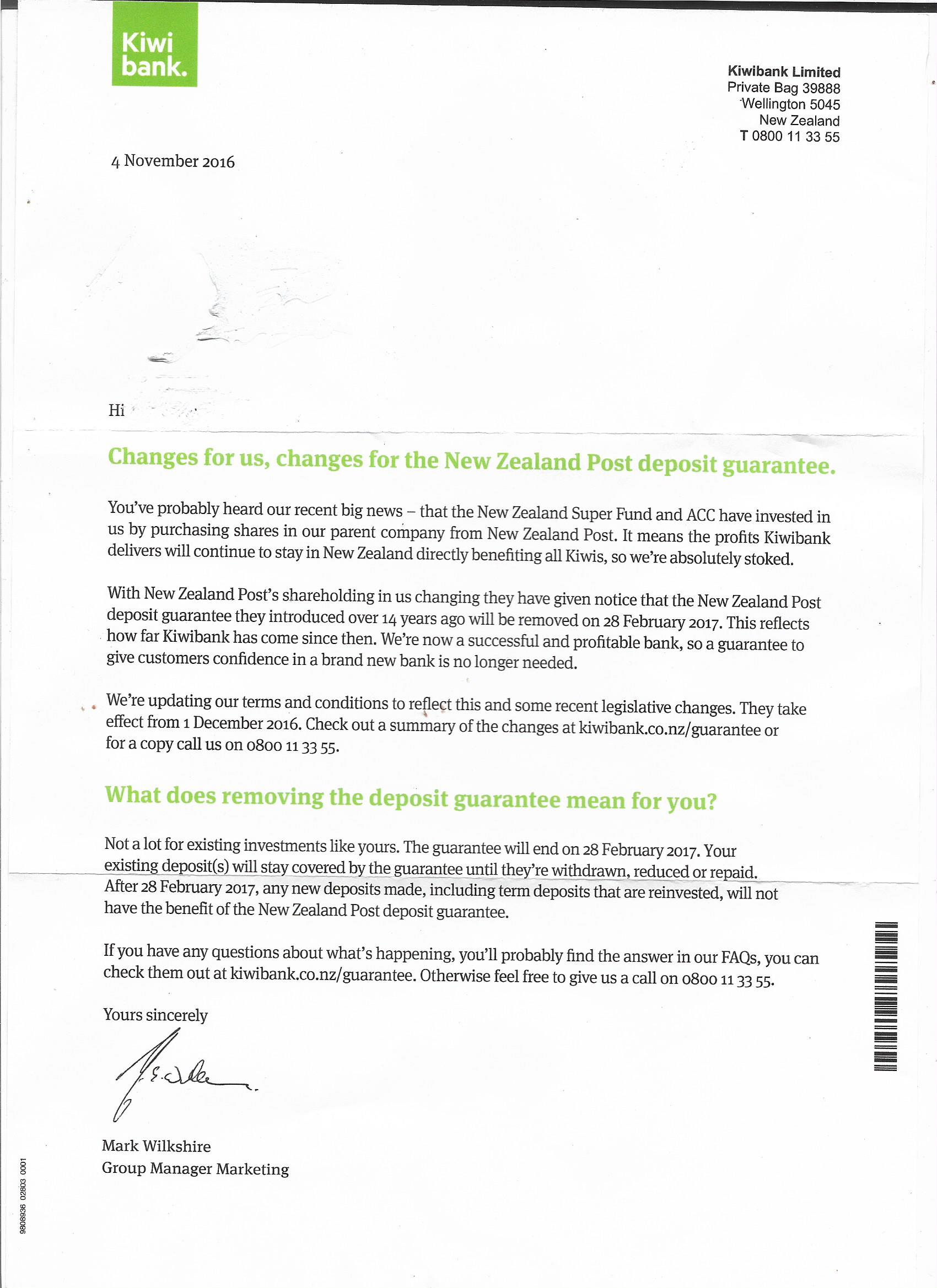

Exulting in this somewhat nebulous benefit the letter to depositors (pictured) devolves into street-language in order to express the full measure of its own enthusiasm for the disappearance of the deposit guarantee scheme. “....So we are absolutely stoked,” declares in his letter to depositors Mark Wilkshire the Kiwibank marketing head.

In the event the investment in the publicly-owned bank has merely diversified. The underpinning is now spread around additional public bodies in the form of the Super Fund and Accident Compensation.

It is not immediately apparent how this public risk-spread will reinforce the retention of profits within New Zealand.

The deftly presented transformation of a marketing drawback, the withdrawal of the guarantee, into a customer benefit underlines though the continuing and misplaced belief that all bank deposits in New Zealand are somehow guaranteed. This continues in spite of assertions, notably from the Reserve Bank, that no guarantee exists.

However the government-sponsored and multi-faceted and attenuated bailing out of the BNZ after the 1987 bust greatly contributed to reinforcing this misapprehension to the effect that all banks, notably the trading banks are covered by a guarantee.

In the event, the publicly-owned Kiwibank was the exception in that its deposits were, and until February 28 will continue to be, underwritten by the state.

From the MSCNewsWire reporters desk - Monday 7 November 2016